You are here

Feed aggregator

SWP-WebMonitor Cybersicherheit und Digitalpolitik Nr. 1/2026

Highlights - Human rights in Kyrgyzstan: follow up on the EP resolution and DROI mission - Subcommittee on Human Rights

Source : © European Union, 2026 - EP

The Axis’s Allies

Policy and security seems to be evolving rapidly, while well established structures for safety and deep traditions of liberal rights are rusting into dust. The erosion of Ministerial Responsibility, a deep rooted tradition in Parliamentary Democracies, have come to a place of almost a lost art as policymakers in Commonwealth countries continue to take policy decisions that have hurt the public without anyone in power losing their position or being held to account. The fact that the Prime Minister of Australia is still sitting in his role without his party ousting him rapidly or him resigning due to negligence that lead to the country’s worst terror massacre it its history does nothing to improve safety.

As is the tradition, Ministerial Responsibility means that whether a Minister knew, or did not know of an incident that hurt the public, it is their duty to resign as they were the only one in power who could have ameliorated the situation. Like in many Western nations, clear mass incitements have taken place alongside actual attacks, and as like those in Australia and abroad, awareness of threats are ever present. As in law, an act could be considered intentional, in that they knew of the coming danger and ignored it with intent, or in considerations of negligence, where they were so derelict of their duty in that position of power that it lead to tragic results. In either case it is considered a crime in law, so for a politician it is a matter of honour to step down and remove the humiliation felt by the nation by placing the onus on their own shoulders, thus taking the mantle of the responsibilities of his role. This concept exists for all fiduciaries in all structures in society, for a Prime Minister or Minister of the Crown to not have the scruples to remove themselves simply shames the nation, the tradition, and erodes society.

This challenge to Western nations and the insecurity felt by the public often has links to events abroad. When considering adversaries to the West, the main challengers must be considered based on public support locals have for their Government, as local often determines actions abroad. When considering Russia and its conflict with Ukraine and NATO allies, the support the public in Russia has for its Government sets it apart from other adversaries of the West. Due to the war not disuniting policy positions in the country, the war will most likely continue as sanctions did not have the intended effect on the popularity of Russia’s Government, and urban based Russian citizens are often the last in line to be placed in the military. If the war can drag on until the West loses it patience, as is often the case, the catalyst for these wars will continue, especially if Western leaders are willing to sit in power after several bouts of corruption.

A recent example of a population not supporting its own Government is the recent removal of Nicolas Maduro from Venezuela. While the Chavistas in Venezuela still hold onto Government power and have structural control of the country, the pressure put on their Government to reform to be benefit of Western powers is paramount after Maduro’s ouster, spurned on by a population that detests its own Government. While the change in Venezuela comes in drips and drabs, the Government can only suppress popular support against their regime to a point, while knowing that any move will lead to conflict with the United States. The only thing that could really salvage their regime would be a popular uprising in support of it, in the streets of Venezuela and abroad, or an American policy that grows weary of pressuring the Chavista regime in Venezuela. The task of the moment is to cut sources of funding to their regime so that the policy can outlast the invisible and ever present deadline for Chavismo in Venezuela, operating to effect not only Venezuela’s Government, but those allies in Cuba, China and Iran. The ripple effect will determine the future in 2026.

Iran at the end of 2025 is experiencing yet another wave of protests, to which the West and irresponsible governments therein continue to ignore to the detriment of citizens there, regionally and abroad. Unlike Russia, the citizenry in Iran do not support their government for the most part, and is moving towards the next step in changing the government. While this has been the case since 2009, the lack of Western support for the people and support galvanizing around a government during wartime means that the only policy solution for their regime is further conflict. With this policy, it is difficult to find a country bordering the regime that is not in conflict with it, and this policy may take these situations so far that even with regime change, conflict would continue for generations. Actions in the West are also tied to Iran, with attacks in Australia coming after evidence was found linking violence in the West to the regime. While it should always be up to locals to change their Government, the world never gave proper support for Iranians, a clear policy display that would be needed towards a change that would calm conflict in the region, abroad, and inside Iran itself.

The question of future conflict with China really comes down to whether or not families would be content donating the lives of their young men for the sake of taking over Taiwan. In most scenarios, China would be successful in dominating Taiwan but at the cost of many lives, just off the coast of some of their biggest cities and communities. It would be difficult to avoid stories of massive losses due to proximity, but also most likely due to families all finding out their one or two sons have been lost, with no one to care for their parents and small children as a result. The second front of the war would likely be in the cold mountainous regions with India, but it would become a conflict involving all of China’s regions. An ongoing conflict would involve defense around Taiwan from the US Navy and Taiwan’s defense forces in the south, Indian Army and Air challenging for lost territory in the West, and Japanese forces challenging in the North East. The conflict would block all trade by sea, removing China’s economic engine in an instant. Having stable trade, even if tariffed or lessened, is a lot easier path than modern warfare, especially from an Army that has not been in an active conflict in generations. China is most likely to act if the West is seen as weak, more reason to have responsible Ministers who are honourable, as opposed to radical entities stripping Constitutional rights from groups in the West for the sake of Anarchy and old hatreds. Most Chinese families would not wish to donate their sons for the sake of war with Taiwan. War can be avoided by both sides, if they choose the right path.

In the end, the this year will be characterized by the US and world economy, and if resulting electoral results will strengthen responsibility and values in the West, or have local politics hinder and neglect public safety and well established rights. Voting truly matters, and the decline is already apparent from bad policy and decision makers filled with negligent narratives. It is time for citizens to take onus of their own duties, their choices in leadership, and the effect on their community and their reputation among civilized nations. Those like the Prime Minister were elected, recently, with a majority government, and this was after many of the violent protests and actions had taken places on the once peaceful streets of his nation. There is no future without being responsible to the past, and honouring the values inherited from several generations that sought peace, order, and good government.

Positioning the Anti-Coercion Instrument in the Greenland Crisis

Press release - MEPs approve “enhanced cooperation” for €90 billion EU support loan to Ukraine

Committee on Budgets

Committee on International Trade

Committee on Security and Defence

Source : © European Union, 2026 - EP

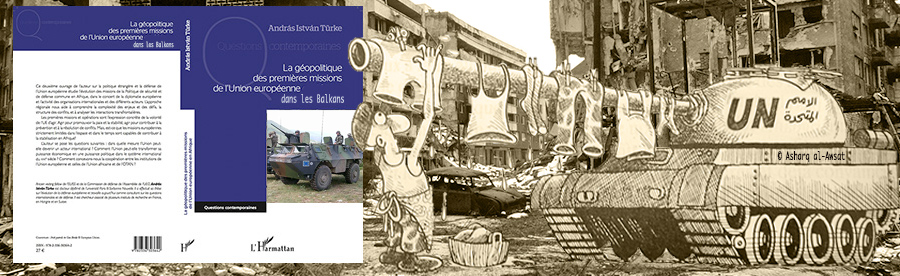

Le « Conseil de paix » de Donald Trump à l'épreuve des Balkans

Entre adhésion assumée, prudence diplomatique et silences calculés, l'initiative de Donald Trump visant à créer un « Conseil de paix » révèle les lignes de fracture au sein des Balkans. Tandis que l'Albanie se range du côté de Washington, la Slovénie, la Roumanie ou la Grèce avancent avec retenue. Le Kosovo et la Turquie ont confirmé leur participation.

- Le fil de l'Info / Courrier des Balkans, USA Balkans, Israël-Palestine , Albanie, Croatie, Grèce, Roumanie, Serbie, Slovénie, TurquieUkrainian Civil Society in Wartime: Transforming for Resistance and Strengthening Resilience

DIW-Vorschlag zur Erbschaftsteuer könnte Zahl der Steuerpflichtigen halbieren und Belastungen gerechter verteilen

Trump-Rede zwischen Show und Erpressung

Beste Reiseziele im April in Europa

Der April ist eine wunderbare Zeit, um Europa zu erkunden. Die Monatsmitte bringt oft milde Temperaturen und weniger Touristen: perfekte Bedingungen für Reisende, die sich nach einer Mischung aus Kultur, Natur und Entspannung sehnen. Im Frühling erwachen viele Städte zu neuem Leben, da blühende Gärten und Sonnenstrahlen das Stadtbild verschönern.

Egal ob Sie historische Stätten in Rom besuchen, eine Grachtenfahrt in Amsterdam genießen oder Barcelonas Strandleben erleben möchten, es gibt zahlreiche Reiseziele, die im April Ihre ganz eigene Magie entfalten. Auch Städte wie Budapest und Dubrovnik laden mit ihren reichen kulturellen Angeboten und Thermalbädern zur Entdeckung ein.

Europa bietet im April eine Vielzahl an attraktiven Reisezielen, in denen Sie sowohl Erholung als auch Abenteuer finden können. Ob antike Ruinen in Athen oder die charmanten Straßen von Lissabon – es gibt immer etwas Besonderes zu entdecken.

Das Wichtigste in Kürze- Amsterdam im April: Tulpenblüte und Grachtenfahrten.

- Barcelona: Angenehmes Wetter, Strandleben und historische Architektur.

- Rom: Sehenswürdigkeiten ohne Sommerhitze und Touristenmassen.

- Lissabon: Milde Temperaturen, Kultur und historische Stätten.

- Budapest: Entspannen in Thermalbädern und erleben von Frühlingsfesten.

Im April ist Amsterdam ein besonders schönes Reiseziel in Europa. Die berühmten Tulpenfelder stehen in voller Blüte und bieten ein farbenfrohes Schauspiel, das man nicht verpassen sollte. Ein weiteres Highlight sind die Grachtenfahrten, bei denen Sie die malerischen Wasserwege der Stadt erkunden können.

Die milden Frühlingstemperaturen machen Spaziergänge durch die Stadt besonders angenehm. Erkunden Sie berühmte Museen wie das Rijksmuseum oder das Van-Gogh-Museum, und genießen Sie die entspannte Atmosphäre der vielen Cafés entlang der Kanäle.

Weiterführendes Material: MSC World Europa Route: Ihr Abenteuer

Barcelona: Angenehmes Wetter und StrandlebenBeste Reiseziele im April in Europa

Barcelona ist bekannt für sein angenehmes Frühlingswetter, das es Besuchern ermöglicht, sowohl die Stadt als auch den Strand zu genießen. Im April erreichen die Temperaturen oft angenehme 15-20 Grad Celsius, was perfekt ist, um durch die Altstadt zu schlendern oder am berühmten Barceloneta-Strand zu entspannen.

Die Kombination aus historischem Charme und moderner Architektur macht Barcelona besonders attraktiv. Genießen Sie einen Spaziergang entlang der Las Ramblas oder besichtigen Sie die beeindruckende Sagrada Família. Nach einem Tag voller Besichtigungen können Sie bei einem Glas Sangria an einer der vielen Strandbars relaxen und das entspannte Lebensgefühl der Katalanen erleben.

Gastronomieliebhaber kommen ebenfalls auf Ihre Kosten: Probieren Sie lokale Delikatessen wie Tapas und frische Meeresfrüchte in einem der zahlreichen Restaurants am Strand oder in den gemütlichen Gassen des Gotischen Viertels.

Das Reisen führt uns zu uns selbst zurück. – Albert Camus

Rom: Historische Sehenswürdigkeiten ohne SommerhitzeIm April ist Rom ein besonders attraktives Reiseziel, da die historische Stadt noch nicht von den sommerlichen Touristenmassen überrannt wird. Dies ermöglicht Ihnen, berühmte Sehenswürdigkeiten wie das Kolosseum und den Vatikan in einer ruhigeren Atmosphäre zu genießen. Das Wetter ist angenehm mild, sodass Sie bei einem Spaziergang durch das Forum Romanum oder entlang der Spanischen Treppe stundenlang die reichhaltige Geschichte der Stadt entdecken können, ohne unter der Sommerhitze zu leiden.

Dubrovnik: Alte Stadtmauern und MeeresbriseDubrovnik im April bietet eine einzigartige Kombination aus Geschichte und Natur. Die alten Stadtmauern, die die Altstadt umgeben, laden zu Spaziergängen mit herrlichem Ausblick ein. Bei einem Bummel entlang der Küste weht Ihnen eine erfrischende Meeresbrise entgegen, die den Frühling in vollen Zügen genießen lässt.

Nützliche Links: MSC Europa 2 Reisen 2024: Luxus pur

.table-responsiv {width: 100%;padding: 0px;margin-bottom: 0px;overflow-y: hidden;border: 1px solid #DDD;overflow-x: auto;min-height: 0.01%;} Reiseziel Highlights Beste Zeit für Aktivitäten Amsterdam Tulpenblüte, Grachtenfahrten April Barcelona Angenehmes Wetter, Strandleben April Rom Historische Sehenswürdigkeiten, milde Temperaturen April Lissabon: Milde Temperaturen und KulturLissabon: Milde Temperaturen und Kultur – Beste Reiseziele im April in Europa

Im April erwartet Sie Lissabon mit milden Temperaturen, ideal für Stadtbesichtigungen und Erkundungen. Die historische Altstadt, das Viertel Alfama, bietet malerische Gassen und atemberaubende Aussichten.

Lissabon beeindruckt durch seine reiche Kultur und Geschichte. Besuchen Sie das berühmte Kloster Mosteiro dos Jerónimos oder den imposanten Torre de Belém. Beide zählen zum UNESCO-Weltkulturerbe. Abends können Sie in einem der zahlreichen Restaurants die traditionelle Küche genießen oder eine Aufführung des melancholischen Fado erleben.

Dank des angenehmen Klimas im April ist ein Bummel entlang des Tejo-Flusses besonders reizvoll. Machen Sie auch einen Ausflug zur magischen Stadt Sintra, nur eine kurze Bahnfahrt entfernt, um romantische Paläste und üppige Gärten zu entdecken.

Zusätzliche Ressourcen: Camping Europa Cavallino: Outdoor-Erlebnis

Budapest: Thermalbäder und FrühlingsfesteBudapest im April bietet eine ausgezeichnete Gelegenheit, die berühmten Thermalbäder der Stadt zu genießen. Die angenehm warmen Quellen sind weltweit bekannt und bieten Entspannung in einer historischen Umgebung. Gleichzeitig blüht die ungarische Hauptstadt während des Frühlings auf: Zahlreiche Frühlingsfeste locken mit traditioneller Musik, Tanz und kulinarischen Spezialitäten. Erkunden Sie den Charme Budapests, während die Stadt in vollem Blütenstand steht.

Athen: Antike Stätten und blühende GärtenWenn Sie nach den besten Reisezielen im April in Europa suchen, sollten Sie Athen in Betracht ziehen. Diese Stadt bietet eine beeindruckende Vielfalt an antiken Stätten, die Ihnen einen Einblick in die reiche Geschichte Griechenlands geben.

Neben historischen Sehenswürdigkeiten wie der Akropolis blühen im Frühling viele Gärten auf und schaffen so eine angenehme Atmosphäre für Spaziergänge. Die milden Temperaturen machen es zu einer idealen Zeit, um durch die Straßen Athens zu schlendern und die kulturellen Schätze der Stadt zu entdecken.

FAQ: Antworten auf häufig gestellte Fragen Wie ist das Wetter in Europa im April? Das Wetter in Europa im April ist meistens mild und angenehm. Die Temperaturen variieren je nach Region zwischen 10 und 20 Grad Celsius. Der Frühling beginnt in vielen Teilen Europas, was bedeutet, dass die Natur zu blühen beginnt und die Tage länger werden. Benötige ich spezielle Kleidung für einen Europa-Trip im April? Ja, es ist ratsam, sich auf wechselhaftes Wetter einzustellen. Packen Sie leichte Kleidung für warme Tage, aber auch einen warmen Pullover oder eine Jacke für kühlere Abend- und Morgenstunden. Ein Regenschirm oder eine wasserfeste Jacke kann ebenfalls nützlich sein, da es im April auch zu gelegentlichen Regenschauern kommen kann. Sind die Sehenswürdigkeiten in Europa im April offen? Die meisten Sehenswürdigkeiten in Europa sind das ganze Jahr über geöffnet. Im April sind viele Attraktionen weniger überfüllt als in der Hochsaison, was zu einem angenehmeren Besuchserlebnis beiträgt. Es empfiehlt sich jedoch, die Öffnungszeiten vorab zu überprüfen, da einige saisonale Beschränkungen gelten können. Sind Flüge und Unterkünfte im April günstiger? April gilt als Nebensaison in vielen europäischen Reisezielen, was bedeutet, dass Flüge und Unterkünfte oft günstiger sind als in den Sommermonaten. Es ist jedoch ratsam, frühzeitig zu buchen, um die besten Angebote zu sichern, insbesondere in beliebten Städten. Wie sind die Menschenmengen in touristischen Gebieten im April? In der Regel sind die Menschenmengen in touristischen Gebieten im April geringer als in der Hochsaison im Sommer. Dies macht den April zu einem idealen Monat, um Sehenswürdigkeiten und Attraktionen ohne lange Warteschlangen zu besuchen und eine entspanntere Atmosphäre zu genießen. Welche Feste und Veranstaltungen finden im April in Europa statt? Im April finden in Europa viele Feste und Veranstaltungen statt, darunter das Osterfest, das in vielen Ländern mit traditionellen Feierlichkeiten begangen wird. In den Niederlanden wird der Königstag gefeiert, in Spanien das Feria de Abril und in Ungarn findet das Budapester Frühlingsfest statt. Jede Region hat Ihre eigenen einzigartigen Events und lokale Feste. Ist es sicher, im April während der COVID-19-Pandemie nach Europa zu reisen? Die Sicherheit während der COVID-19-Pandemie hängt von den aktuellen Beschränkungen und Maßnahmen in den einzelnen Ländern sowie der persönlichen Reiseplanung ab. Informieren Sie sich vor Ihrer Reise über die geltenden Vorschriften, wie Quarantänebestimmungen, Testanforderungen und Impfungen. Es ist auch ratsam, flexible Buchungsoptionen für Flüge und Unterkünfte zu wählen.Der Beitrag Beste Reiseziele im April in Europa erschien zuerst auf Neurope.eu - News aus Europa.

Jubilant Senegal fans join the Afcon champions parade

Press release - Parliament to fast-track support loan for Ukraine

Committee on Budgets

Committee on International Trade

Committee on Security and Defence

Source : © European Union, 2026 - EP

Die unsichtbare Macht der Fossilokratie, die die Welt beherrscht

UN-Hochseeabkommen: Wer kontrolliert das Wissen über die Hohe See?

Mit dem Inkrafttreten des Abkommens der Vereinten Nationen zum Schutz der Hohen See am 17. Januar ist ein wichtiger Schritt zum Erhalt der »Biodiversität außerhalb nationaler Gerichtsbarkeit« (BBNJ) vollzogen worden. Das BBNJ-Abkommen zielt darauf ab, den transparenten und vielfältigen Austausch von Wissen über die Hohe See zu fördern, um ökologische Standards zu stärken. Angesichts einer geopolitischen Lage, in der Wissen selbst zunehmend politisiert wird, stellt sich jedoch die Frage, wie diese Wissensvielfalt langfristig gesichert werden kann.

Der Clearing-House-Mechanismus: Technisches Werkzeug oder politischer Hebel?Im Zentrum dieser Auseinandersetzung steht ein unscheinbar klingendes Instrument: der sogenannte BBNJ-Clearing-House-Mechanismus (CHM). Er soll eine frei zugängliche Plattform werden, auf der Informationen über Aktivitäten auf Hoher See gesammelt, ausgewertet und geteilt werden. Zu seinen Zielen gehören die Stärkung der Transparenz zwischen den Vertragsparteien und relevanten Interessengruppen sowie die Erleichterung internationaler Zusammenarbeit, vor allem in wissenschaftlichen Fragen. Während Ziele und Grundstruktur des CHM im Vertragstext festgelegt sind, ist seine konkrete Ausgestaltung Gegenstand laufender politischer Verhandlungen - und gerade das macht den Mechanismus politisch umkämpft.

Der Vertragstext eröffnet ausdrücklich die Möglichkeit, im CHM unterschiedliche Wissensformen in Entscheidungsprozesse einzubeziehen. Insbesondere im Rahmen der verpflichtenden Umweltverträglichkeitsprüfungen könnten unterschiedliche Wissensformen systematisch einbezogen werden. Staaten müssten dabei nicht nur potenzielle Umweltauswirkungen bewerten, sondern auch wirtschaftliche, soziale, kulturelle, gesundheitliche und kumulative Effekte geplanter Aktivitäten. Eine solche umfassende Folgenabschätzung erfordert Beiträge aus verschiedenen wissenschaftlichen Disziplinen ebenso wie das Wissen indigener Völker und lokaler Gemeinschaften.

Eine weitere Möglichkeit zur praktischen Umsetzung von Wissenspluralismus zeigt sich in den Bestimmungen zur Zusammensetzung des wissenschaftlich-technischen Gremiums. Die entsprechende Formulierung im Abkommen deutet darauf hin, dass dieses über rein naturwissenschaftliche Expertise hinausgehen und ein breiteres Spektrum lokaler, traditioneller und indigener Wissensformen zur Meeresumwelt einbeziehen soll. Da das Gremium Handlungsempfehlungen für Aktivitäten in Gebieten jenseits nationaler Hoheitsgewalt auf Grundlage der über den CHM bereitgestellten Informationen aussprechen kann, bietet sich hier ein zentraler Hebel für die praktische Umsetzung von Wissensvielfalt. Voraussetzung ist jedoch, dass das Gremium tatsächlich so zusammengesetzt wird, dass unterschiedliche Wissensarten angemessen vertreten sind.

Politische Konflikte verzögern die Umsetzung des AbkommensTrotz des vielversprechenden Wortlauts des Vertrags ist die konkrete Ausgestaltung des CHM politisch umstritten. In der Vorbereitungskommission (PrepCom) zur Operationalisierung des Abkommens zählt sie zu den zentralen Konfliktfeldern. Auf einem Treffen der PrepCom im August 2025 scheiterte bereits eine Einigung über die Zusammensetzung einer informellen Expertengruppe zur Ausarbeitung der technischen Aspekte des CHM. Dieser Auswahlprozess ist von strategischer Bedeutung, da er einen Präzedenzfall für die Besetzung weiterer BBNJ-Gremien schaffen könnte. Während einige Staaten auf eine breite Einbindung unterschiedlicher Wissensträger drängen, wollen andere den CHM auf eine rein naturwissenschaftlich-technische Funktion reduzieren, die allein von akademischer Expertise geleitet werden sollte. Kritiker warnen, dass ein solcher Ansatz naturwissenschaftliches Wissen aus dem globalen Norden privilegiert und sozialwissenschaftliche, lokale oder traditionelle Wissensformen marginalisieren würde.

Vor dem Hintergrund jüngster Versuche einzelner Staaten, darunter der USA, den Zugang zu marinen Daten einzuschränken, wird deutlich, dass Wissen über die Meere zunehmend selbst zum Gegenstand politischer Auseinandersetzungen wird. Deutschland und die EU haben sich in internationalen Prozessen wiederholt für die Freiheit und Vielfalt der Wissenschaft ausgesprochen. Im Rahmen der laufenden Verhandlungen zur Operationalisierung des BBNJ-Abkommens sollten sie sich daher gezielt dafür einsetzen, dass Wissensvielfalt innerhalb des Abkommens nicht nur normativ anerkannt, sondern institutionell abgesichert wird. Dabei geht es vor allem darum, die Privilegierung bestimmter Wissensarten innerhalb von BBNJ-Gremien, wie dem wissenschaftlich-technischen Gremium, zu verhindern. Zugleich muss die CHM-Plattform so ausgestaltet werden, dass verschiedene Wissensformen gleichermaßen zugänglich sind.

Reclaiming Iraqi Agency

The higher turnout in Iraq’s recent parliamentary elections reflects advances over the past four years, notably in infrastructure development, security, and political stability. The election’s outcome and ensuing coalition-building dynamics underscore trends and challenges that will shape Iraq’s domestic and foreign policies. The yet-to-be-formed government will have to balance between the United States and Iran, facing US demands for disarmament of Iraq’s armed groups, managing repercussions of potential instability in Iran, and resisting being drawn into any new confrontation between Iran and either Israel or the United States. It will also have to deal with substantial domestic challenges, including strained relations between Erbil and Baghdad, the potential for renewed Sunni alienation from the state, the future of the Popular Mobilization Forces, financial fragility, and consequences of climate change. European actors have limited influence over the geopolitical dynamics, but can offer support on national development and climate challenges, and should back Baghdad’s striving for stronger agency and sovereignty.

Senegalese fans celebrate dramatic Afcon win

The US military intervention in Venezuela and the regional and geopolitical context

Written by Marc Jütten with Angelos Delivorias.

Venezuela under Nicolás MaduroNicolás Maduro assumed the Presidency of Venezuela on 8 March 2013, following Hugo Chávez’s death on 5 March. In the subsequent presidential elections on 14 April 2013, Maduro, who represented the governing Socialist Unified Party of Venezuela (Partido Socialista Unido de Venezuela/PSUV), won narrowly over Henrique Capriles, the candidate of the opposition coalition, Democratic Unity Roundtable (Mesa de la Unidad Democrática/MUD).

Since Maduro took power, the country has been suffering from the effects of a deep economic, political, social and humanitarian crisis. Hyperinflation (over 130 000 % in 2018) and large shortages of essential goods were the results of the economic policies and governmental mismanagement under Chávez and Maduro, combined with declining oil production, the global drop in oil prices in 2014, corruption and the impact of US sanctions. As a result, in recent years, 7.9 million Venezuelans have left the country, seeking safety and better opportunities, with more than 6.9 million people (85 %) being hosted in Latin America and the Caribbean. According to the European Commission, around 56 % of the population live in extreme poverty; 40 % of the population experience moderate to severe food insecurity; around 62 % of the population does not have regular access to water; and 70 % of the population have lost access to health system services.

Read the complete study on ‘The US military intervention in Venezuela and the regional and geopolitical context‘ in the Think Tank pages of the European Parliament.

Farben, Muster und Materialien richtig kombinieren

Ein stimmiges Einrichtungskonzept entsteht selten zufällig. Es ist das Ergebnis bewusster Entscheidungen, bei denen Farben, Muster und Materialien ineinandergreifen und sich gegenseitig unterstützen. Räume wirken dann harmonisch, wenn nichts dominiert und alles zusammengehört. Genau hier liegt die Herausforderung, denn jedes Element für sich kann stark wirken. Erst im Zusammenspiel zeigt sich, ob ein Wohnkonzept wirklich funktioniert und langfristig Ruhe ausstrahlt.

Farben als emotionales Fundament des RaumesFarben bilden die Basis jeder Raumgestaltung. Sie beeinflussen nicht nur die Stimmung, sondern auch die Wahrnehmung von Größe, Licht und Temperatur. Warme Farbtöne wirken einladend und gemütlich, während kühle Nuancen Klarheit und Struktur vermitteln. Entscheidend ist, dass Farben nicht isoliert betrachtet werden. Eine Wandfarbe entfaltet ihre Wirkung immer im Kontext von Möbeln, Böden und Textilien.

Ein durchdachtes Farbkonzept arbeitet meist mit wenigen Hauptfarben, die sich im Raum wiederholen. Zu viele unterschiedliche Töne können schnell Unruhe erzeugen. Harmonisch wirkt es, wenn eine dominante Farbe von zurückhaltenden Nuancen begleitet wird. So entsteht Tiefe, ohne den Raum optisch zu überladen. Farben sollten außerdem zur Nutzung des Raumes passen, denn ein Wohnzimmer stellt andere Anforderungen als ein Arbeits- oder Schlafbereich.

Muster gezielt einsetzen statt wahllos kombinierenMuster verleihen Räumen Charakter und Dynamik. Sie können beleben, strukturieren oder Akzente setzen. Gleichzeitig bergen sie das Risiko, einen Raum unruhig wirken zu lassen, wenn sie unkontrolliert eingesetzt werden. Deshalb ist Zurückhaltung entscheidend. Muster sollten gezielt platziert werden und immer einen klaren Zweck erfüllen.

Besonders wichtig ist das Zusammenspiel von Mustern und Farben. Großflächige Muster benötigen meist ruhige Begleiter, damit sie ihre Wirkung entfalten können. Kleine Muster lassen sich leichter kombinieren, sollten aber ebenfalls in ein klares Farbkonzept eingebettet sein. Ein Raum wirkt ausgewogen, wenn Muster nicht miteinander konkurrieren, sondern sich ergänzen und visuell miteinander verbinden.

Materialien als verbindendes Element im WohnkonzeptMaterialien bestimmen maßgeblich, wie ein Raum wahrgenommen wird. Holz, Stein, Metall, Glas und Textilien bringen unterschiedliche Oberflächen, Temperaturen und Strukturen mit. Ein harmonisches Wohnkonzept lebt davon, diese Gegensätze bewusst zu kombinieren. Glatte Oberflächen profitieren von weichen Materialien, während natürliche Strukturen durch klare Formen an Eleganz gewinnen.

Wichtig ist, dass Materialien nicht zufällig gewählt werden. Wiederholungen schaffen Zusammenhalt. Wenn ein Material an mehreren Stellen auftaucht, wirkt der Raum automatisch stimmiger. Dabei geht es nicht um Perfektion, sondern um ein ausgewogenes Verhältnis. Materialien sollten sich gegenseitig unterstützen und dem Raum Tiefe verleihen, ohne ihn schwer oder überladen erscheinen zu lassen.

Tapete als Verbindung zwischen Farbe und MaterialWandgestaltung nimmt eine besondere Rolle im Interior Design ein, da sie große Flächen beeinflusst und den Rahmen für alle anderen Elemente bildet. Genau hier kann Tapete ihre Stärke ausspielen. Sie verbindet Farbe, Muster und Material auf eine Weise, die mit reiner Wandfarbe oft nicht möglich ist. Durch Struktur, Prägung oder textile Oberflächen entsteht zusätzliche Tiefe.

Richtig eingesetzt kann sie Räume definieren, Akzente setzen oder eine ruhige Basis schaffen. Entscheidend ist, dass sie in das Gesamtkonzept eingebunden wird. Farben sollten sich in Möbeln oder Accessoires wiederfinden, Materialien mit anderen Oberflächen im Raum harmonieren. So wirkt sie nicht wie ein Fremdkörper, sondern wie ein selbstverständlicher Bestandteil des Wohnkonzepts.

Balance zwischen Kontrasten und Ruhe findenEin gelungenes Einrichtungskonzept lebt von Kontrasten, aber ebenso von Ruhe. Gegensätze wie hell und dunkel, glatt und rau oder modern und natürlich sorgen für Spannung. Diese Spannung sollte jedoch dosiert eingesetzt werden. Zu viele starke Kontraste können einen Raum unruhig wirken lassen und die gewünschte Harmonie stören.

Ruhe entsteht durch Wiederholung und klare Linien. Wenn Farben, Muster oder Materialien mehrfach aufgegriffen werden, entsteht ein roter Faden. Kontraste wirken dann gezielt und nicht zufällig. Ein Raum sollte dem Auge Orientierung bieten. Genau diese Balance macht den Unterschied zwischen einer zusammengewürfelten Einrichtung und einem durchdachten Wohnkonzept aus.

Räume ganzheitlich denken statt einzelne Elemente zu bewertenEin häufiger Fehler bei der Einrichtung besteht darin, einzelne Möbelstücke oder Materialien isoliert zu betrachten. Ein harmonisches Ergebnis entsteht jedoch nur, wenn der Raum als Ganzes gesehen wird. Jede Entscheidung beeinflusst die nächste. Farben verändern Materialien, Muster beeinflussen die Raumwirkung, Licht verstärkt oder mildert Kontraste.

Wer Räume ganzheitlich plant, schafft Wohnbereiche, die nicht nur optisch überzeugen, sondern sich auch im Alltag bewähren. Harmonie zeigt sich dann nicht durch Perfektion, sondern durch ein stimmiges Zusammenspiel. Ein Zuhause wirkt besonders einladend, wenn es Ruhe ausstrahlt, Persönlichkeit zeigt und das Gefühl vermittelt, dass alles seinen Platz gefunden hat.

Der Beitrag Farben, Muster und Materialien richtig kombinieren erschien zuerst auf Neurope.eu - News aus Europa.